More than two dozen House Democrats are demanding that congressional leaders secure adequate funding for the Internal Revenue Service in an upcoming appropriations bill to ensure that “wealthy tax cheats” like President Donald Trump are no longer able to skirt their obligations while the poor continue to face intense government scrutiny.

In a letter to Democratic and Republican leaders on Monday, 25 House Democrats led by Reps. Bill Pascrell, Jr. (D-N.J.) and Judy Chu (D-Calif.) called for a fiscal year 2021 “funding level of $12.1 billion for the Internal Revenue Service (IRS), including $5.2 billion for enforcement activities that are critical to ensuring compliance.”

“Recent estimates by the Congressional Budget Office underscore the importance of IRS enforcement activities, noting that increasing the IRS’s budget to investigate high-income individuals would more than pay for itself by allowing the IRS to effectively collect unpaid taxes owed by the wealthiest individuals,” the lawmakers noted.

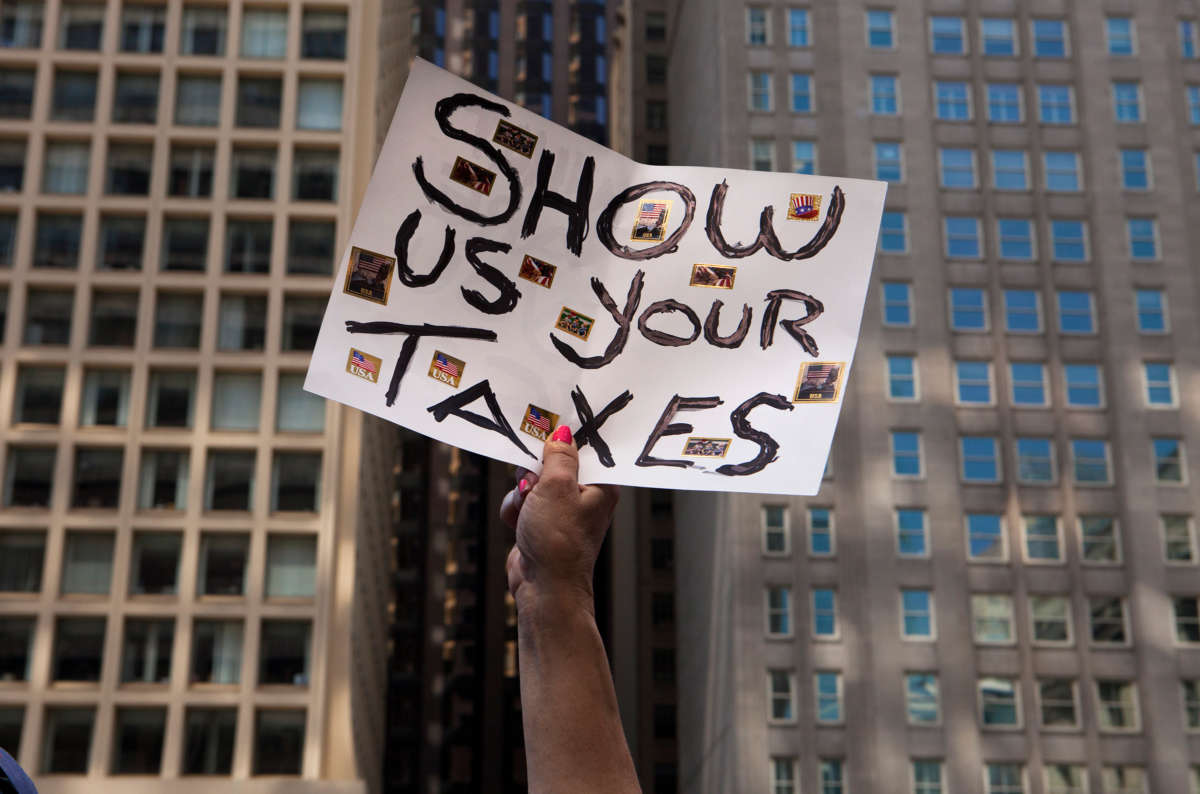

“Millionaire tax dodgers like Donald Trump get away with paying little to no federal income tax in part because IRS funding has dropped over 20% since 2010,” Chu tweeted Monday, referring to recent New York Times reporting showing that Trump paid just $750 in federal income taxes in both 2016 and 2017.

As Americans’ trust in the IRS plummets, @RepJudyChu and I are leading 25 House members calling on congressional leadership to increase IRS funding to after rich tax cheats. pic.twitter.com/Hr53L0rUDE

— Bill Pascrell, Jr. (@BillPascrell) November 30, 2020

In July, as Common Dreams reported, a CBO report commissioned by Sen. Bernie Sanders (I-Vt.) found that the amount of unpaid taxes from 2011 to 2013 averaged over $380 billion per year. “Enforcement activity for many high-income nonfilers,” the CBO found, “has been reduced to a series of notices.”

The CBO analysis came on the heels of reporting by ProPublica which found that, given the high costs of auditing the rich, the IRS now “audits the working poor at about the same rate as the wealthiest 1%.”

“The IRS has acknowledged that’s true,” ProPublica noted, “but professes it can’t change anything unless it is given more money.”

To bolster their demand for increased funding, the group of House Democrats pointed to the CBO’s conclusion that “increasing the examinations and collections budget by $20 billion over 10 years increases revenues by $61 billion, and if it is increased by $40 billion over 10 years it would increase revenues by $103 billion.”

“This is a matter of tax fairness,” the lawmakers wrote. “The IRS should not continue an enforcement program focused on low-income taxpayers, singling out Earned Income Tax Credit (EITC) recipients, just because it is cheaper and easier.”

Read the House Democrats’ full letter:

Dear Speaker Pelosi, Majority Leader McConnell, Chairman Quigley, Chairman Kennedy, Ranking Member Womack, and Ranking Member Coons:

As you work to finalize the Fiscal Year (FY) 2021 Financial Services and General Government (FSGG) appropriations bill, we urge you to retain the House-passed funding level of $12.1 billion for the Internal Revenue Service (IRS), including $5.2 billion for enforcement activities that are critical to ensuring compliance with our voluntary tax system and protecting taxpayer dollars from fraud.

The strength of IRS enforcement activities must be a priority for Congress, especially considering the additional measures Congress enacted under the CARES Act to lessen the financial burden of the Covid-19 pandemic. For example, the IRS’s Criminal Investigation division identified $2.3 billion in tax fraud in FY 2020, up $500 million or almost 28 percent from 2019. According to the recent FY 2020 report, much of the group’s work in recent months has focused on fraud connected to economic relief lawmakers passed this year in response to the coronavirus pandemic, including cases of fraudulent claims for economic impact payments, Paycheck Protection Program loans and refundable payroll tax credits.

Recent estimates by the Congressional Budget Office underscore the importance of IRS enforcement activities, noting that increasing the IRS’s budget to investigate high-income individuals would more than pay for itself by allowing the IRS to effectively collect unpaid taxes owed by the wealthiest individuals. Specifically, increasing the examinations and collections budget by $20 billion over 10 years increases revenues by $61 billion, and if it is increased by $40 billion over 10 years it would increase revenues by $103 billion. This is a matter of tax fairness as well. The IRS should not continue an enforcement program focused on low-income taxpayers, singling out Earned Income Tax Credit (EITC) recipients, just because it is cheaper and easier. We urge you to preserve the $5.2 billion level of funding from the House-passed FSGG appropriations bill in order to ensure IRS can effectively collect taxes, including those owed by the top 1% of taxpayers.

Again, we strongly support $12.1 billion for IRS in the final FY 2021 appropriations bill, especially for enforcement. Thank you for your attention to this important matter.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $24,000 by the end of today. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.