At one of the many high-dollar fundraisers Hillary Clinton held during the month of August, a personal-check donation of $100,000 would get an attendee a photo with Hillary, according to a recent New York Times article. Rubbing shoulders with the likes of Paul McCartney at a waterfront Hampton’s estate fund-raiser, Hillary “joined in a sing-a-long finale to ‘Hey Jude’.”

The release this past week of the 2015 poverty and income data was met with enthusiasm — witness headlines such as the one in the New York Times, “The Economic Expansion is Helping the Middle Class, Finally” or the conclusion of Matthew Yglesias on the Vox website that “the bottom line of all of this is that as good as the 2015 census report was, the reality is probably even better. . . the data shows pretty clearly that despite those problems, we are currently living through the best of times.”

The report was certainly good news. But as other commentators observed, incomes have yet to return to the levels they were at the onset of the Great Recession in 2007. Moreover, although everyone enjoyed rising incomes in 2015, the income inequality gap did not narrow. And, as Eduardo Porter points out in the New York Times, with the economic expansion “getting long in the tooth. … the punch bowl may well be taken away again before the party really gets going.”

As I wrote at Jewish Currents last week, income inequality is approaching historic highs. Yet, as skewed as income inequality is, wealth inequality is more concentrated and deepening.

Drawing on the work of the Berkeley economists Emmanuel Saez and Gabriel Zucman, I have created the following five charts that show not only substantial growth in wealth inequality, but an even more lopsided distribution than that for income inequality.

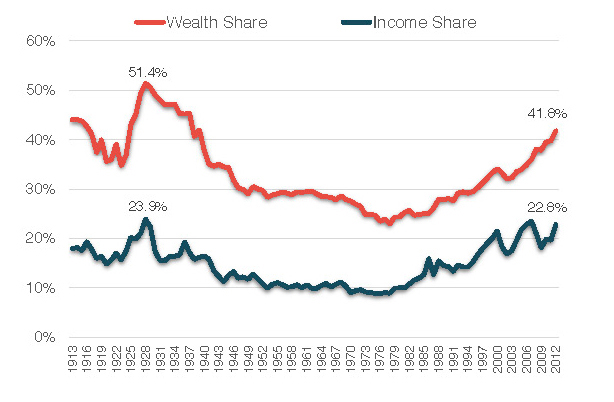

The rich get richer, the rest get poorer: Since the late-1970s, the top one percent of families have been steadily accumulating a larger share of the nation’s wealth (total assets people own net of their debts), recessions notwithstanding. In 2012 (the most recent available data), the top one percent of families (1.6 million families, each with at least $4 million in assets in 2012) held about 42 percent of all the wealth. Although still below the 1928 peak of 51 percent, the growth has been spectacular, almost doubling in close to 40 years.

As large as income inequality is, the 42 percent wealth share held by the top one percent of families far surpasses the 22 percent income share held by the top one percent in the income distribution (see my Jewish Currents article).

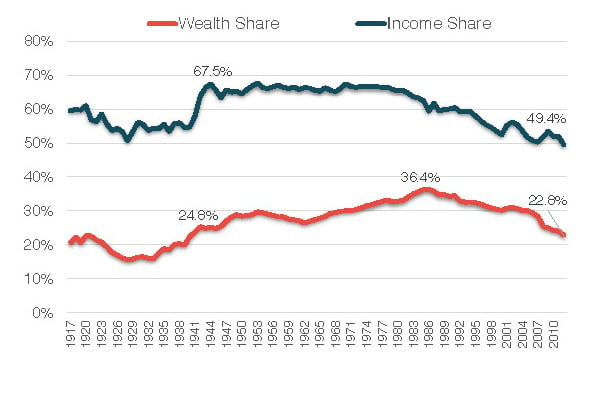

By contrast, the share of wealth held by the bottom 90 percent (almost 145 million families) has been depleting steadily, falling from a high of 36.4 percent in 1984 to 22.8 percent in 2012. The income share of the bottom 90 percent is less, but still severely, skewed, standing at almost 50 percent in 2012.

Wealth and Income Share of the Top 1%, 1913-2012

(Source: The World Wealth and Income Database and Gabriel Zucman)

(Source: The World Wealth and Income Database and Gabriel Zucman)

Wealth and Income Share of the Bottom 90 Percent, 1913-2012

(Source: The World Wealth and Income Database and Gabriel Zucman)

(Source: The World Wealth and Income Database and Gabriel Zucman)

The rich are entrenching their wealth.

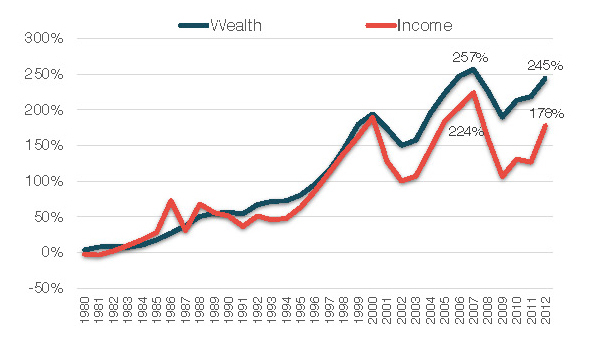

The wealthy are growing their wealth by more than their income as they pull even further away from the bottom 90 percent. Since 1979, the real average wealth of the top one percent of families has grown 245 percent — from 4 million dollars, on average, to almost 14 million dollars (in 2010 dollars) per family. Over the same period, the income growth of the top one percent of families, although impressive, has not been as spectacular, increasing by 178 percent.

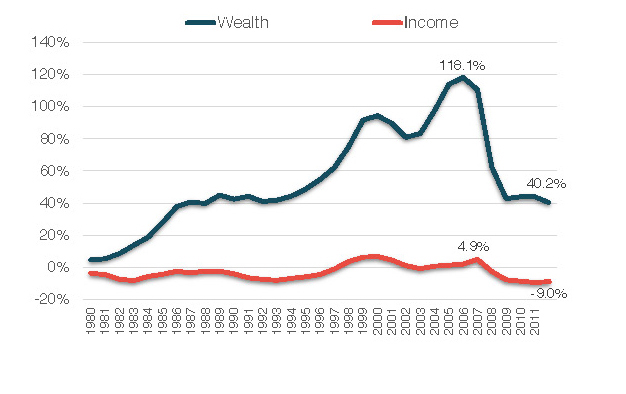

The real average wealth of the bottom 90 percent, by contrast, fell dramatically after the Great Recession, plummeting from the 118 percent growth mark reached in 2006 to a 40 percent increase in 2012. The real average wealth of the bottom 90 percent of families, which was $60,000 (2010 dollars) in 1979, rose to a peak of $130,000 in 2006, before falling to almost $84,000 in 2012. Over the same 1979 to 2012 period, the bottom 90 percent of families also saw their real average incomes decline by 9 percent.

Change in Real Average Wealth and Income of the Top 1% Since 1979

(Source: The World Wealth and Income Database and Gabriel Zucman)

(Source: The World Wealth and Income Database and Gabriel Zucman)

Change in Real Average Wealth and Income of the Bottom 90 Percent Since 1979

(Source: The World Wealth and Income Database and Gabriel Zucman)

(Source: The World Wealth and Income Database and Gabriel Zucman)

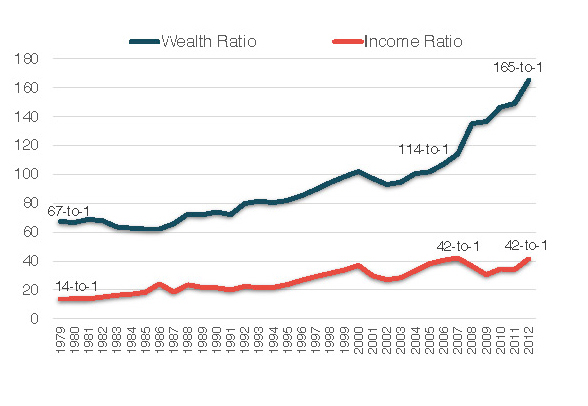

The dramatic increase in wealth inequality is also illustrated by the stunning growth in the ratio of wealth held by the top one percent to the bottom 90 percent of families. In 1979 the real average wealth held by the top one percent was 67 times larger than the bottom 90 percent. By 2012, this ratio had increased to 165 times, while the disparity in real average income between the top one percent and the bottom 90 percent expanded from 14-to-1 to 42-to-1.

Wealth and Income Ratios of the Top 1% to the Bottom 90 Percent, 1979-2012

(Source: The World Wealth and Income Database and Gabriel Zucman)

(Source: The World Wealth and Income Database and Gabriel Zucman)

Although the reduction in poverty and the increase in incomes should be welcomed, it should not distract from the tremendous wealth and income inequality that still exists and continues to deepen. As Bill Moyers points out: “an ugly truth about America: inequality matters.” Quoting Louis Brandeis, he writes: “we may have democracy, or we may have wealth concentrated in the hands of a few, but we can’t have both.”

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.