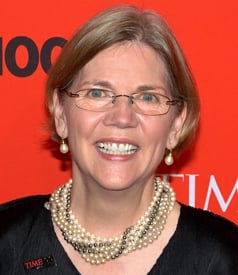

Washington – President Barack Obama’s decision to appoint Harvard Law School professor Elizabeth Warren on Friday to oversee the creation of the new Bureau of Consumer Financial Protection cheered consumer advocates and Democrats Thursday, while dismaying Republicans and business groups.

Warren was one of the intellectual architects of the new bureau, created by the recent legislation to overhaul financial regulations. The agency is mandated to guard against dangers to consumers from financial products such as mortgages and credit cards, much as the Consumer Product Safety Commission does for toys or jewelry tainted by lead.

A specialist in contract law who rose to national prominence from humble Oklahoma roots, Warren is loved by consumer advocates for her charge-ahead style — and loathed by many business groups for the same reason.

Because she’s a lightning rod, she faced a tough Senate confirmation fight if Obama nominated her to head the new bureau for a five-year term as its formal director. The Senate battle could’ve lasted months.

To avoid that, Obama chose to make her an assistant to the president and special adviser to Treasury Secretary Timothy Geithner, a staff position that doesn’t require Senate confirmation. The White House will announce her appointment on Friday, an administration official told McClatchy on condition of anonymity because the announcement’s not yet public.

Even without being named the bureau’s director, Warren’s expected to wield broad power — hiring the staff and setting the mission. Once she’s got the bureau up and running, Obama can appoint a formal director, to whom Warren could pass the baton of leadership, the administration official said.

Consumer advocates were thrilled.

“We at the National Consumer Law Center have worked with Elizabeth Warren for years and are excited that she will be instrumental in setting the course for the Consumer Financial Protection Bureau. Elizabeth has a deep understanding of the needs of consumers and the ways in which the financial system has let them down,” the advocacy group said in a statement.

In a similar statement, the group Americans for Financial Reform said, “As financial reform moves through the treacherous path of regulation writing, Wall Street is busy trying to thwart regulators from doing the job Congress laid out — keeping the big banks in check. With Elizabeth Warren leading the way, and the public keeping up its vigilance, they will not succeed.”

The U.S. Chamber of Commerce was appalled.

“By not allowing Ms. Warren’s nomination to be considered through the regular order of the full Senate confirmation process, the administration has circumvented one of the very few checks on a big new agency that already has been given an unprecedented concentration of regulatory powers,” David Hirschmann, the president of the chamber’s Center for Capital Markets Competitiveness, said in a statement. “This maneuver is an affront to the pledge of transparency and consumer protection that’s purported to be the focus of this new agency.”

Sen. Olympia Snowe, R-Maine, also was unhappy.

“This agency has enormous, wide-ranging powers, and we can only assess that in a thorough confirmation process. I regret the president is circumventing that process. It’s not about Elizabeth Warren. What the president has done raises a very critical question about the direction the president intends to take with the bureau. There are a lot of issues to be explored. To do this in the shadows is only going to facilitate more cynicism,” Snowe told McClatchy.

On the other hand, Sen. Jeff Merkley, D-Ore., a Senate Banking Committee member, was delighted.

“It’s a superb appointment by the White House. The bill is structured so the agency would be set up in Treasury. She’s just the right person to be leading the effort.”

Republicans consider Warren hostile to the financial services sector. However, she wears that as a badge of honor, unabashedly critical of how banks duped homeowners and credit card holders in the run-up to the financial system’s near collapse in 2008.

In “Capitalism: A Love Story,” by liberal filmmaker Michael Moore, Warren made clear her distaste for bank-underwritten mortgages that she felt were wrong for many consumers.

“Financial products, and they are products just like posters, are sold today with the most dangerous features embedded in them because that’s what drives profitability,” she said in an interview that’s an extra on the DVD version. “You can’t buy a toaster in America that has a one-in-five chance of exploding, but you can buy a mortgage that has a one-in-five chance of exploding, and they don’t have to tell you about it.”

“We have consumer protection for everything you touch, taste, feel . . . but there’s no equivalent for credit cards, for mortgages, there’s nothing,” Warren added.

Warren’s had a prickly relationship with Geithner, who on paper will be one of her two bosses, Obama being the other.

As the head of the special Congressional Oversight Panel looking into how bank bailout funds are spent, she’s clashed repeatedly with Geithner for what she said was a lack of cooperation and transparency. Warren’s panel also issued a scathing report last October condemning the lack of progress in the Obama administration’s efforts to stem foreclosures.

(David Lightman contributed to this article.)

ELIZABETH WARREN: AT A GLANCE

_ A Harvard University School of Law professor, specializing in contract law.

_ The author of two best-selling books, The Two Income Trap, and All Your Worth.

_ A former chief adviser to National Bankruptcy Review Commission.

_ A member of the Economic Inclusion Committee of the Federal Deposit Insurance Corp.

_ Named by National Law Journal as one of top 50 most influential women attorneys.

_ A former Sunday School teacher with law degree from Rutgers University, and an undergraduate degree from the University of Houston.

_ Born on June 22, 1949, in Oklahoma City and raised in Norman, Okla.

ON THE WEB

Warren’s Michael Moore Interview

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $43,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.