This week at the COP26 climate conference in Glasgow, President Biden assured world leaders that the United States would meet its pledge to cut its greenhouse gas emissions in half by 2030 compared with 2005 levels.

But for Biden or a future president to get the U.S. to achieve that, they’ll almost certainly have to get legislation beyond the pared-down Build Back Better Act passed that restricts fossil fuels, an industry in which dozens of senators and their households are personally invested. The households of at least 28 U.S. senators own investments in the fossil fuel industry worth as much as a combined $12.6 million, according to Sludge’s analysis of financial disclosures.

The investments are valued at a combined minimum of $3.7 million and a maximum of $12.6 million, and many of them have been held by the lawmakers for at least three years. Of the 28 senators, at least 20 hold publicly-traded stocks in companies like oil supermajor Chevron, pipeline giant Enterprise Products, or electric utility NextEra that belong to trade associations that are lobbying Congress against taking up strong legislation to curb polluting emissions. Five senators are invested in energy funds built around oil and gas assets, and three own non-public stock in private fossil fuel companies. The investments, held by the senators, their spouse, jointly, or a dependent, are disclosed to the Senate Office of Public Records in very broad ranges and often buried in hundreds of pages of scanned paper forms, making a more precise count of their total value impossible.

(Click the arrow in the table above to view all senators.)

The recent Emissions Gap Report from the United Nations Environment Programme forecasts that on current trajectories, including climate change mitigation pledges, global temperature will rise by 2.7 degrees Celsius by the end of the century. “That is well above the goals of the Paris climate agreement and would lead to catastrophic changes in the Earth’s climate,” the report states.

The Biden White House had set a goal of net-zero emissions from the power sector by 2035, toward a net-zero economy no later than 2050. Congress is developing climate provisions in the budget reconciliation bill that may be voted on as soon as today in the House, after the major environmental programs of a clean energy standard and a fee on methane emissions were cut from the package at the direction of Sen. Joe Manchin (D-W.V.). The latest Build Back Better Act would spend over $546 billion on climate measures over a 10 year window, encompassing dozens of initiatives, as outlined in the section-by-section summary posted on the Rules Committee website.

Three Energy Subcommittee Dems Invested

The Energy and Natural Resources Subcommittee on Energy has jurisdiction over “global climate change,” “oil and natural gas regulation,” and “oil, gas and coal production and distribution,” among other things. The households of three of the eight Democratic members of the committee are invested in fossil fuels, including the two senators with the most valuable investments among all members of the chamber.

The senator with the most fossil fuel wealth is Energy and Natural Resources Committee Chair and Energy Subcommittee ex-officio member Joe Manchin, whose non-public stock and accounts receivable from a pair of family-owned companies, coal brokerage Enersystems and coal mining servicer Farmington Resources, is valued at between $1.2 and $5.5 million. Manchin’s household has received over $1 million in income in the past two years from Enersystems as the senator has stripped the Democrats’ budget reconciliation bill of major climate programs that would have transitioned coal-fired plants like the one where the company, now run by his son, holds a prime fuel services contract. Manchin’s committee also added more than $11.3 billion in funding to the bipartisan infrastructure bill that could benefit his family company’s niche waste coal industry.

This year, utilities are burning 20 percent more coal compared with last year, according to the U.S. Energy Information Administration (EIA), which with greater energy consumption after the lifting of some coronavirus pandemic measures has led to an increase of 8% in energy-related carbon dioxide emissions. Coal leapfrogged nuclear power this year to become the second-biggest source of American electricity, after natural gas, the EIA agency reports.

Two other senators among the seven Democratic members of the Energy and Natural Resources Committee’s Subcommittee on Energy benefit from fossil fuel company stock: John Hickenlooper, who has up to $1 million invested in fossil fuel companies including Chevron; and Democrat-caucusing Independent Angus King, whose spouse has up to $50,000 in electric company NextEra Energy, one of the largest electric power generators from natural gas in the U.S.

Also on the subcommittee is Republican Roger Marshall, with a maximum of almost $100,000 invested in the industry, led by his household’s 5% stake in Kansas-based energy logistics company MV Purchasing. That asset, described as “Oil working interest (Stafford County, KS),” earned Marshall’s household between $50,000 and $100,000 in income last year as “rent/royalties.” In addition, Marshall’s spouse disclosed earning between $250,000 and $500,000 through a March 1 sale of 20% interest in oil royalties at Quivira Ranch, in the same Kansas county.

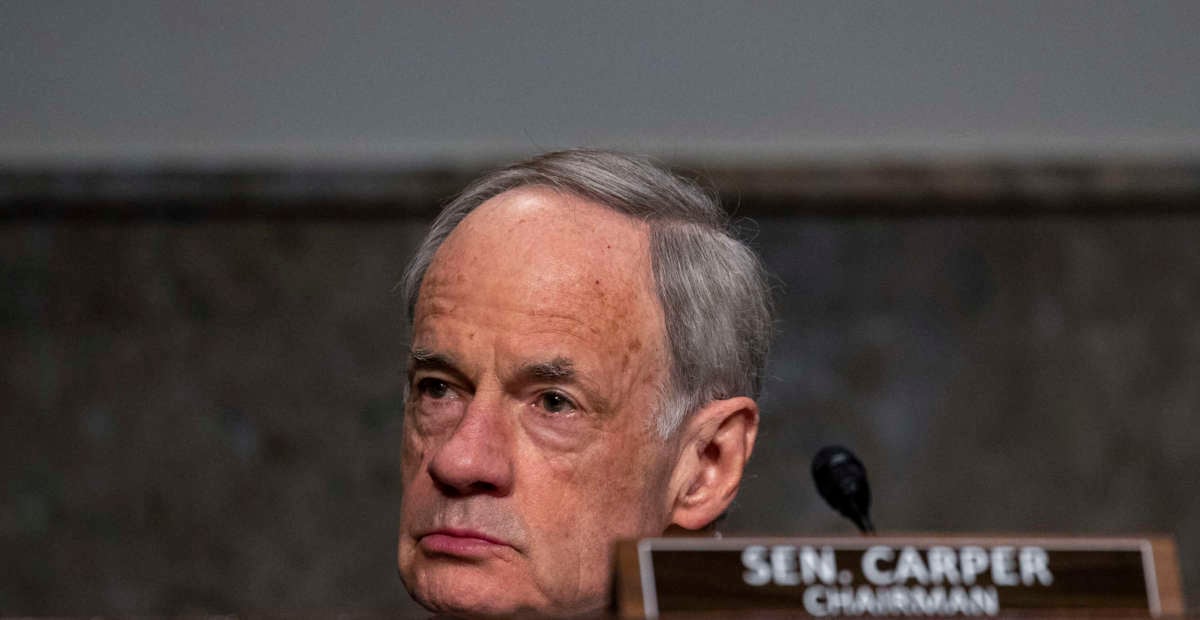

Tom Carper of Delaware, chair of the Committee on Environment and Public Works, which oversees air pollution and environmental policy, has household holdings of fossil fuel companies worth up to $274,000, including stock in Chevron and Duke Energy. He’s joined on the committee by a pair of Republican stockholders: John Boozman, with up to $60,000 in oil companies, and Shelley Moore Capito of West Virginia, with a maximum investment with her spouse of up to nearly $300,000 as she serves as the ranking member of the Subcommittee on Regulatory Oversight.

Democrat Gary Peters of Michigan has held on to fossil fuel industry investments from 2018, totaling a maximum of $355,000 in companies like electric utilities NextEra, which pays millions in dues to the powerful Electric Edison Institute lobbying group, and electric services company DTE Energy, which currently has four coal plants in operation. In 2019, Peters added up to $50,000 worth of stock in natural gas and electricity provider Pacific Gas and Electric Company (PG&E) to his portfolio.

Republican Bill Hagerty of Tennessee owns as much as almost $1.5 million in nine fossil fuel companies, led by up to half a million dollars in pipeline firm Enterprise Products Partners, a member of top national lobbying groups the American Petroleum Institute (API) and American Fuel & Petrochemical Manufacturers (AFPM), and the same amount in methane gas giant Energy Transfer. Ted Cruz jointly holds with his spouse up to $400,000 in Houston-based Enterprise Products, Texas-headquartered ExxonMobil, and Oklahoma-based ONE Gas.

The UK research group InfluenceMap, which analyzes lobbying and communications, this month found that ExxonMobil and Chevron are the top two most negatively influential global companies on Paris-aligned climate policy. Exxon has spent about $4.6 million on political and social issue ads on Facebook so far this year, promoting itself as part of the climate change solution while its officials hold leadership positions in trade groups including API and U.S. Chamber of Commerce. Chevron’s first–ever climate lobbying report this year did not attempt to reckon with its trade associations’ lobbying against policies to reduce greenhouse gas emissions.

In total, senators’ households have as much as $275,000 invested in ExxonMobil and as much as $370,000 invested in Chevron.

InfluenceMap’s analysis found that the most negatively influential lobby groups on emissions policy were API, AFPM, the U.S. Chamber of Commerce, and the National Mining Association. API’s millions spent on Facebook ads this year have recently opposed the Build Back Better Act as “anti-industry legislation,” and have promoted “natural gas” as a solution. A 2019 report from over a dozen major environmental groups including 350 and the Center for Biological Diversity found that leaking methane from gas energy would push the world over the emissions bounds of the Paris Agreement, a conclusion affirmed in May by the International Energy Agency, which backed the winding down by 2040 of oil, gas, and coal power plants.

Rick Scott, who won his Florida seat by 0.2% of the general election vote in 2018, reported that his spouse holds an investment worth up to $500,000 in AG Energy Credit Opportunities Fund IV, LP. Announced last year, the fund aimed to raise $1.5 billion to buy the distressed debt of oil and gas companies and was offered by Angelo Gordon, a New York-based alternative investment firm that extends credit to companies in the North American oil and gas industry. The Scotts also have several investments in municipal bonds in the natural gas industry, not included in this analysis as they are reported as government securities, worth up to a total of over $3 million as of 2020.

Several senators have disclosed selling off fossil fuel industry investments since their 2019 reports. Ron Wyden’s spouse sold up to $50,000 in ExxonMobil on August 21, divesting in full from ExxonMobil, as well as from shares in industrial conglomerate General Electric, whose stock is owned by at least five other senators. Dianne Feinstein no longer reports an asset of $1,000 in gas company Antero Midstream that she and her investor spouse held in 2019. Republican John Hoeven of North Dakota, the ranking member of the Subcommittee on Energy and a member of the Appropriations Subcommittee on Energy, no longer reports holding several oil assets that he did in 2019, including stock in Chevron, ExxonMobil, Marathon, and others that had been worth a combined $550,000 maximum.

The average age of a senator at the start of the 117th Congress was 64.3 years, according to the Congressional Research Service. The median age of the 28 senators included in this analysis is 66 years, topped by Angus King at 77, Joe Manchin and Tom Carper at 74, and John Boozman at 70. Based on average U.S. life expectancy, most of the Senate’s fossil fuel investors will be dead before the planet reaches 1.5 degrees Celsius of warming above pre-industrial levels as projected by the U.N. to hit between 2030 and 2052, beyond which the most deadly impacts of climate change will begin being felt by those still alive.

Methodology

To define assets in the fossil fuel industry, Sludge primarily used the company list from the No Fossil Fuel Money pledge, a project of the nonprofit advocacy group Oil Change U.S., which is searchable online and downloadable in full. The investment funds listed in this analysis, including several Vanguard Energy funds and Energy Select Sector, each received “F” grades from Fossil Free Funds, a resource from the nonprofit shareholder advocacy group As You Sow. A handful of assets were manually categorized, including AG Energy Credit Opportunities Fund. Data is current as of Nov. 3, 2021. Stock holdings and value ranges were disclosed in 2020 annual financial disclosures, new filer disclosures, and periodic transaction reports published by the Senate Office of Public Records.

Misc. Findings

- Mark Warner reported selling up to $250,000 in Maryland-based energy company Empire Petroleum Partners LLC on February 5, as an “Underlying asset of Sachs Capital - Empire B, LLC,” but the Virginia Democrat still holds a stake potentially worth up to $400,000 in his portfolio.

- Mike Crapo of Idaho reports royalty income last year of over $16,000 from a 3% stake in a subsurface mineral rights lease in North Dakota. While this asset was not included in this analysis without more information, McKenzie County is the site of oil and gas production according to an industry resource.

- Richard Burr and his spouse sold up to $165,000 in Enterprise Products stock in late April, according to Senate reports.

- Independent Angus King’s spouse unloaded shares of ConocoPhillips, ExxonMobil, and oilfield services company Schlumberger in August 2020 worth a combined maximum of $45,000.

- Tom Carper’s spouse sold a corporate bond in oil and gas exploration company Energen valued at up to $15,000 on June 21 of this year, though her household still holds the company’s securities.

- John Kennedy, ranking member of the Appropriations Subcommittee on Energy and Water Development, reports a one-third interest in APK Minerals LLC, of Olympia, Washington, which did not last year have an assigned investment value.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $44,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.