Congress may be gridlocked, but that doesn’t mean President Obama’s hands are tied. On Wednesday the president announced that he’s moving to ease Americans’ student debt load with an executive order that would save borrowers “hundreds of dollars a month” in student loan payments.

Called the “Pay As You Earn” plan, starting January 2012 people would be able to cap their federal student loan payments at 10 percent of their discretionary income. Any remaining debt would be forgiven after 20 years. This cap was due to take effect in two years, but Obama’s moved the timetable up. In his speech at the University of Colorado at Denver, Obama said that the plan, which would also allow students to consolidate their federal student loans under a lower interest rate, could help around 1.6 million Americans ease their monthly bills.

“Let me tell you,” Obama told the cheering crowd. “I remember this. I remember writing, like, five different checks to five different agencies and if you lost one that month you couldn’t get all the bills together. And if you missed the payment, suddenly you were paying a penalty.”

Obama’s proposal isn’t exactly a new idea, but rather a revision. It’s lifted from the IBR, or the income-based repayment plan, which was signed into law in September 2007 by President George W. Bush. Bush’s initiative allowed students to cap their federal student loan payments at 15 percent of their discretionary income, and allowed students to walk away from the rest of their debt after 25 years.

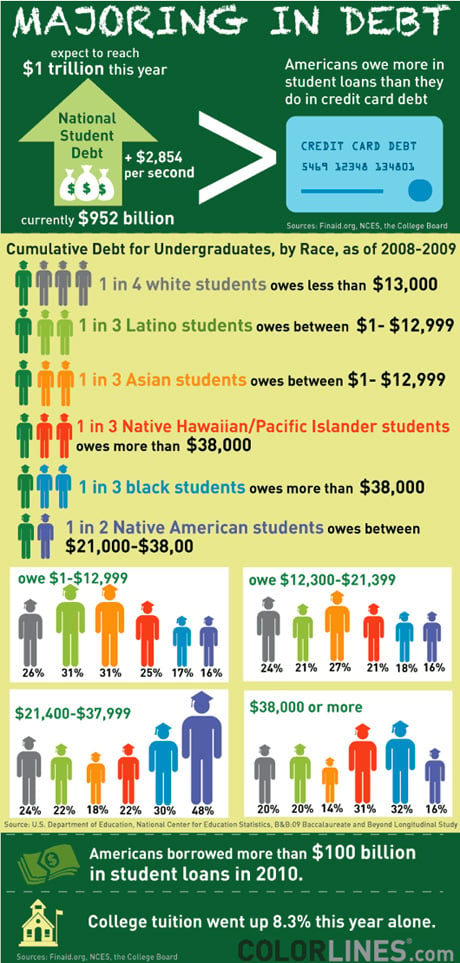

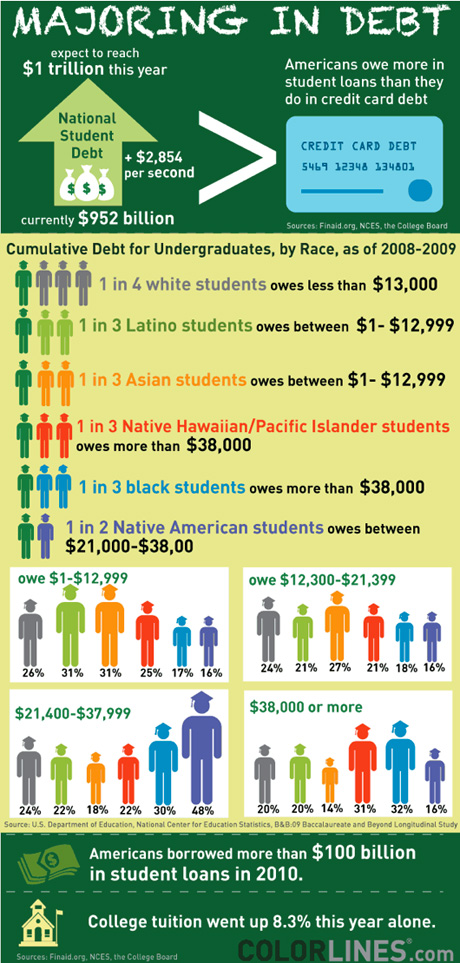

But Obama’s executive order comes at an especially dire time, when college costs are rapidly increasing and with it, the amount of debt students are taking on in order to pay for school. Among those who borrow to pay for school, students of color are disproportionately saddled with high levels of debt. We rounded up the latest numbers that show exactly how much debt college graduates are carrying around with them these days, and who’s in need of relief.

Reprinted with permission of Colorlines.com. Sign up to receive Colorlines Direct, a weekly email digest of key stories on Colorlines.com. You'll get award-winning news from our multi-racial team of writers covering hot topics and a broad range of issues from a racial justice perspective.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.