While the expanded child tax credit was still being sent to families last year, Democrats held a huge electoral advantage over Republicans among recipients. Now, nearly four months after the credit expired, Democrats have completely lost that edge, new polling has found.

According to polling of roughly 2,000 respondents from Morning Consult/Politico, in December, child tax credit recipients said that they would vote for Democrats over Republicans 49 percent to 37 percent, or by a 12-point margin.

After the last checks were sent out that month, however, support for Democrats began decreasing. In February, the two parties were roughly tied; in polls conducted in the last week or so, Republicans now have an edge over Democrats in congressional elections of about three points, with about 46 percent support.

The polls indicate that if Democrats want to capture more of the vote in the midterm elections this fall, they should go big on economic policies like the expanded child tax credit. Polling on other popular issues has also demonstrated this; recent polling by Data for Progress has shown that taking action on student debt would drive a significant amount of voters in key battleground states to go to the polls and vote Democrat this fall.

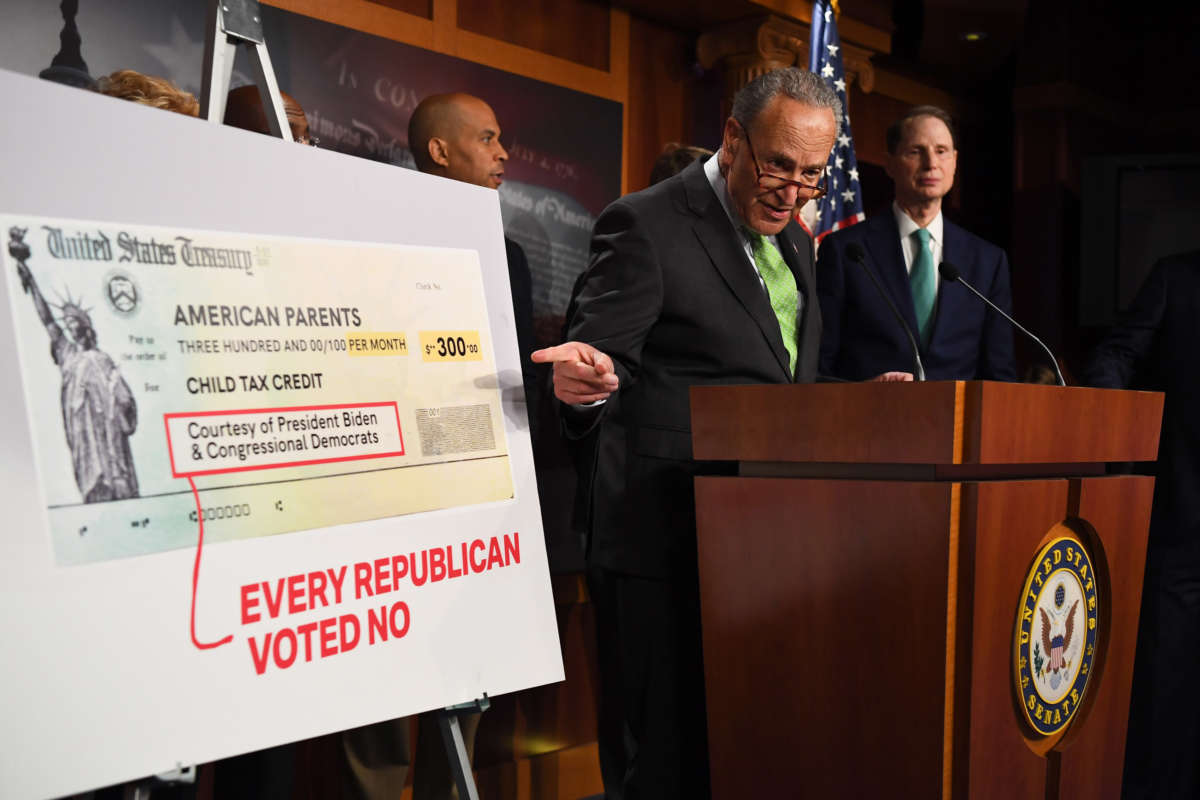

The child tax credit expansion, which sent families hundreds of dollars each month to ease child care costs, died last year when conservative Sen. Joe Manchin (D-West Virginia) loudly announced his opposition to the idea.

In private conversations, Manchin callously suggested — without evidence — that beneficiaries were using the credit to buy drugs. In public, he advocated for placing a work requirement on the proposal if it did go through, and promoted bad faith claims that the credit was encouraging people not to work.

Recent research has debunked that claim, however. A newly released research brief from Washington University in St. Louis and Appalachian State University researchers found that the child tax credit had no significant effect on employment, and that those who received the credit were actually employed at higher rates than people who didn’t.

In fact, employment of beneficiaries only dropped sharply when the expanded tax credit expired in December, with employment rates dropping from 72 percent to 68 percent. The data suggests that the child tax credit actually helps people keep their jobs so that they can afford child care, the costs of which can drive people out of work in order to care for their children full time.

“Many parents can’t work right now because they can’t afford childcare, but they can’t afford childcare because they can’t work,” said Greg Nasif, public affairs director for poverty eradication group Humanity Forward. “Reverting the Child Tax Credit back to monthly payments could help break this vicious cycle for millions of families and end the decline of employment.”

Extending the expanded child tax credit wouldn’t just be good politics for Democrats — it would also have huge impacts on families’ finances and the economy at large. In a working paper released last month, researchers found that for every dollar invested in families with children, there would be a return of $10 in societal and economic benefits; if low-income families with one child received an extra $1,000 a year, the program would cost $97 billion and generate $982 billion in benefits.

The child tax credit was hugely beneficial in lifting and keeping Americans out of poverty. Data shows that child poverty increased by a whopping 41 percent after the credit expired.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.