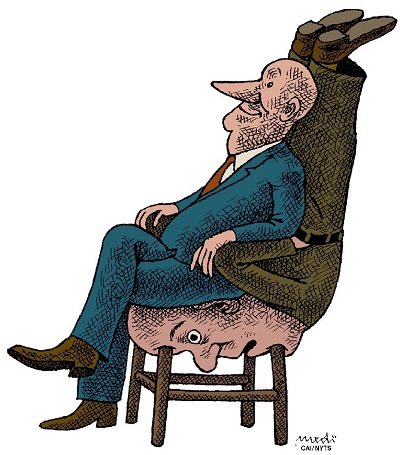

(Image: MEDI; Albania / CartoonArts International / The New York Times Syndicate)Recently the big, front-page headline on the Financial Times website – at least in the U.S. edition – led to an article about the Bank for International Settlements. According to the F.T., the bank is warning that “forward guidance” – the attempt to drive long-term interest rates down by promising to keep short-term rates low for a long time – “could endanger the international financial system.” Typical B.I.S., I thought – the gnomes of Basel have been consistently against any policies that might restore full employment, and have been into punishment all the way. And I got ready to write a blog post bashing the organization.

(Image: MEDI; Albania / CartoonArts International / The New York Times Syndicate)Recently the big, front-page headline on the Financial Times website – at least in the U.S. edition – led to an article about the Bank for International Settlements. According to the F.T., the bank is warning that “forward guidance” – the attempt to drive long-term interest rates down by promising to keep short-term rates low for a long time – “could endanger the international financial system.” Typical B.I.S., I thought – the gnomes of Basel have been consistently against any policies that might restore full employment, and have been into punishment all the way. And I got ready to write a blog post bashing the organization.

But first I thought I should check the actual B.I.S. report cited in the article – and it’s not very much like the description in the Financial Times. Yes, it mentions possible risks to financial stability, but it also talks about the reasons for forward guidance and the need for some kind of unconventional stimulus; if it seems somewhat down on the policy, it’s more about doubtful effectiveness than about looming doom. In other words, the fear factor here is more about the Financial Times projecting its own prejudices onto the B.I.S. than the B.I.S.’s actual assessment.

And that, I think, is an indicator. The urge to hike rates – the rationale keeps changing, but the demand stays the same – is widespread in the financial press. Why? The ever-changing reasons for a never-changing policy suggest that we aren’t really talking about policy analysis. Instead we’re talking about some mix of class interest (rentiers want their rents) and desire to see economics as a morality play (easy money feels good, therefore it must be bad).

Anyway, quite amazing. And I worry that the incessant drumbeat for rate hikes will eventually wear the central bankers down.

Don’t Prosper and Die Early

I was pleased to see the article by the reporter Annie Lowrey in The New York Times earlier this month documenting the growing disparity in life expectancy between the haves and the have-nots.

It’s kind of frustrating, however, that this is apparently coming as news not just to many readers, but to many policymakers and pundits. Many economists have been trying for years to get this point across – to point out that when people call for raising Social Security and Medicare ages, they’re basically saying that janitors must keep working because corporate lawyers are living longer. Yet it never seems to sink in.

Maybe this article will change that. But my guess is that soon we will once again hear a supposed wise man saying that we need to raise the retirement age to 67 in the United States because of higher life expectancy, unaware that (a) life expectancy hasn’t risen much for half of workers and (b) we’ve already raised the retirement age to 67.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $31,000 in the next 48 hours. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.