More evidence has emerged showing that the Trump administration provided a profoundly different outlook to the public about the possible effects of the coronavirus pandemic than it did behind closed doors in the weeks leading up to.

On February 24, Trump wrote on his Twitter account that Americans shouldn’t be worried.

“The Coronavirus is very much under control in the USA,” Trump tweeted out. “We are in contact with everyone and all relevant countries. CDC & World Health have been working hard and very smart. Stock Market starting to look very good to me!”

But hours before Trump tweeted, White House economic officials had offered a much more sober and uncertain outlook to members of the conservative Hoover Institution, a think tank based out of Stanford University, which may have helped investors on Wall Street capitalize on the uncertainty the pandemic would bring to markets, according to reporting from The New York Times.

During that meeting, Tomas Philipson, who at the time served as the chairman of the Council of Economic Advisers in the Trump administration, told the group he could not estimate what effects coronavirus would have on the economy.

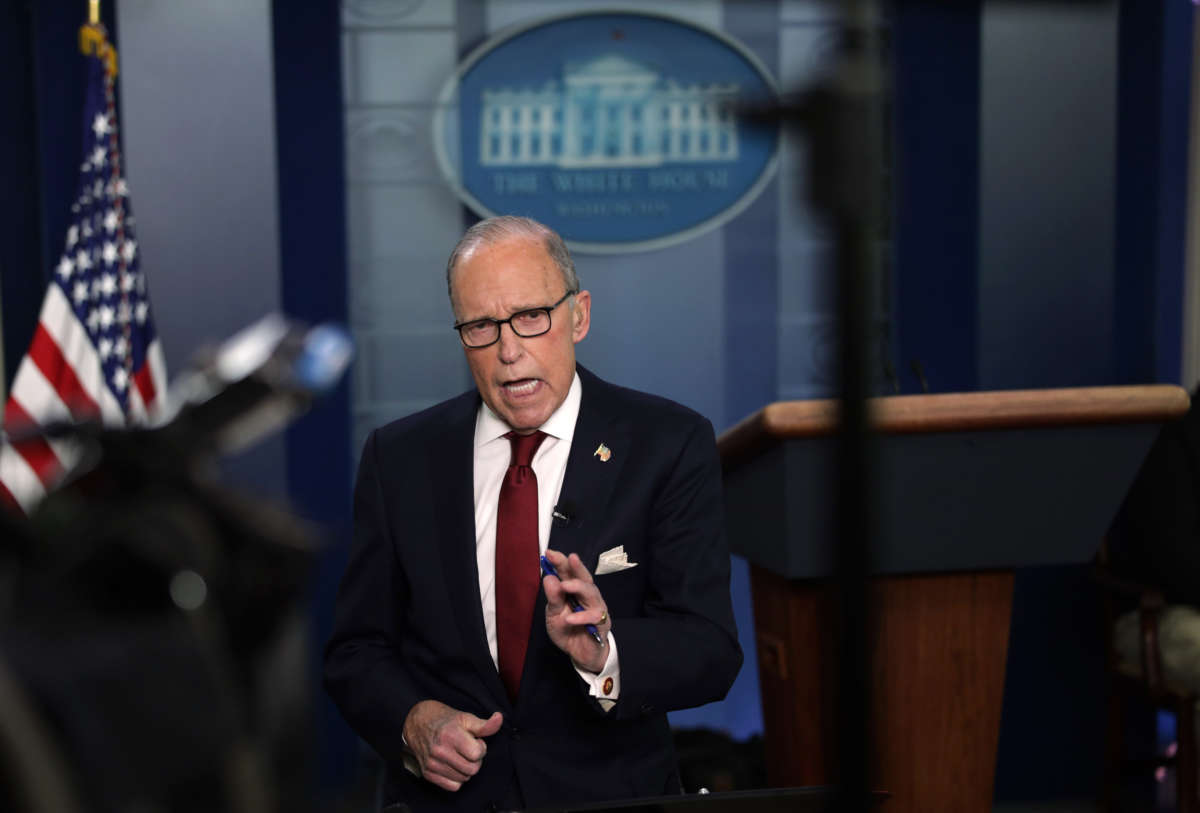

The cautious tone from the White House continued into the following day, when Larry Kudlow, director of the National Economic Council, asserted that COVID-19 was indeed contained, but added “now we just don’t know” about the potential for economic fallout.

Later that day, Kudlow offered a more optimistic outlook to the public, stating on CNBC that containment of the virus was “pretty close to airtight.”

The meetings appeared to influence investment decisions by finance capital. William Callanan, a consultant who was in attendance of the three-day gathering of Hoover’s board in Washington at that time, authored a memo that he later shared with the founder of Appaloosa Management, a hedge fund company. Within that memo, Callanan appeared to overstate the gravity of the known situation, but his overall point was clear: What Trump officials were saying in public wasn’t matching what they were saying in private, particularly on economic matters relating to COVID-19.

Callanan expressed concern in the document over the fact that the administration’s words appeared to be “totally unprovoked” — and perhaps signaled that they believed the economic consequences would be far worse than what they were willing to state publicly.

Callanan’s memo at Appaloosa was circulated within the company, later being sent out to other outside investors, too. Within a 24-hour period of time, at least four money-management firms in the U.S. had received the information that detailed Callanan’s opinions on what Trump officials had said in private.

Investors appeared to have been influenced by the information. According to two investors who spoke with the Times, the memo convinced them that the markets were going to drop. “Short everything” was their overall trading strategy after learning about the administration’s outlook, according to the Times.

Within two weeks of the Hoover Institute meeting with Trump officials and Callanan sharing his memo with Appaloosa, markets had tanked, with the Dow Jones Industrial Average dropping by over 14 percent.

The investors do not appear to have acted illegally, but the events highlight how the Trump administration provided one outlook to the public while telling investors, many of who are politically aligned with the president, a completely different story.

Trump continued to downplay coronavirus in the days after the Hoover Institution met with members of his administration. Later in February, for example, he described criticisms of his preparations for the virus (or lack thereof) to be a “new hoax” perpetrated against him by Democrats and the media.

Yet in private, even Trump himself acknowledged that wasn’t the case, telling journalist Bob Woodward earlier in the month that coronavirus posed a “deadly” threat to the nation, and that it would be more dangerous than the flu. A month later, the president also admitted to Woodward that he purposely played down the threat in public statements to avoid creating a “panic.”

Other lawmakers have faced scrutiny after appearing to have capitalized from insider information about the potential economic impacts of the pandemic in its early months. Sen. Kelly Loeffler (R-Georgia), for instance, reportedly dumped millions of dollars in stocks she owned tied to industries that were set to take a financial hit due to COVID-19, even as she downplayed such worries in public statements to her constituents. Sen. Richard Burr (R-Georgia) is also accused of having sold off his stocks after having received a briefing on the severity of coronavirus, and is currently under investigation.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.