There have been a lot of comparisons between President Donald Trump and President Richard Nixon, but Warren G. Harding’s 1920s administration — and the Teapot Dome scandal that tainted his presidency — may actually be a better guide to what’s going on right now. The scandal also helps address the question of whether Chairman of the House Ways and Means Committee Richard Neal (D-MA) can lawfully request Trump’s tax returns from the IRS.

This request takes on extra urgency in light of the news that Trump’s sister Judge Maryanne Trump Barry recently retired from the federal bench, thereby ending an inquiry into her taxes. Both siblings stand accused by the New York Times of allegedly violating tax laws for years.

On April 3, Chairman Neal asked the IRS to provide Trump’s personal tax returns and the tax returns of several of his business entities. As the debate unfolds over whether Congress has the authority to obtain the president’s tax returns, it’s worth considering two outcomes of Teapot Dome: (1) Congress has the authority to obtain the president’s tax returns and (2) Congress can compel testimony from hostile witnesses.

Chairman Neal’s request for Trump’s taxes came after the president’s ex-lawyer Michael Cohen testified before Congress on February 27 that as a businessman, Trump allegedly inflated the value of assets to apply for bank loans and deflated the same assets to avoid paying taxes.

In his testimony before Congress on April 9, a visibly shaking IRS Commissioner Charles Rettigbobbed and weaved around questions of how his agency has handled Congress’ request for the president’s tax returns. Rettig also testified that Treasury Secretary Steven Mnuchin had been involved in the debate over releasing the president’s tax returns. On April 13, Neal sent a second letter reiterating his demand and setting April 23, 2019 as the deadline for the IRS to comply.

The fight over the president’s tax returns may turn into an interbranch brawl, but it shouldn’t have to because the issue is clearly covered by a 1924 federal statute. In the meantime, if Congress cannot get the IRS to comply with their request, they can call on witnesses with personal knowledge of the tax returns to testify.

Often considered the greatest scandal in U.S. politics before Watergate, the Teapot Dome scandal involved Secretary of the Interior Albert B. Fall’s no-bid contract to lease federal oil fields in Teapot Dome, Wyoming to a private company on April 7, 1922. Congress’ investigation of the scandal centered on the question, “How did Interior Secretary Albert Fall get so rich so quickly?” Fall was eventually convicted of taking a $100,000 bribe.

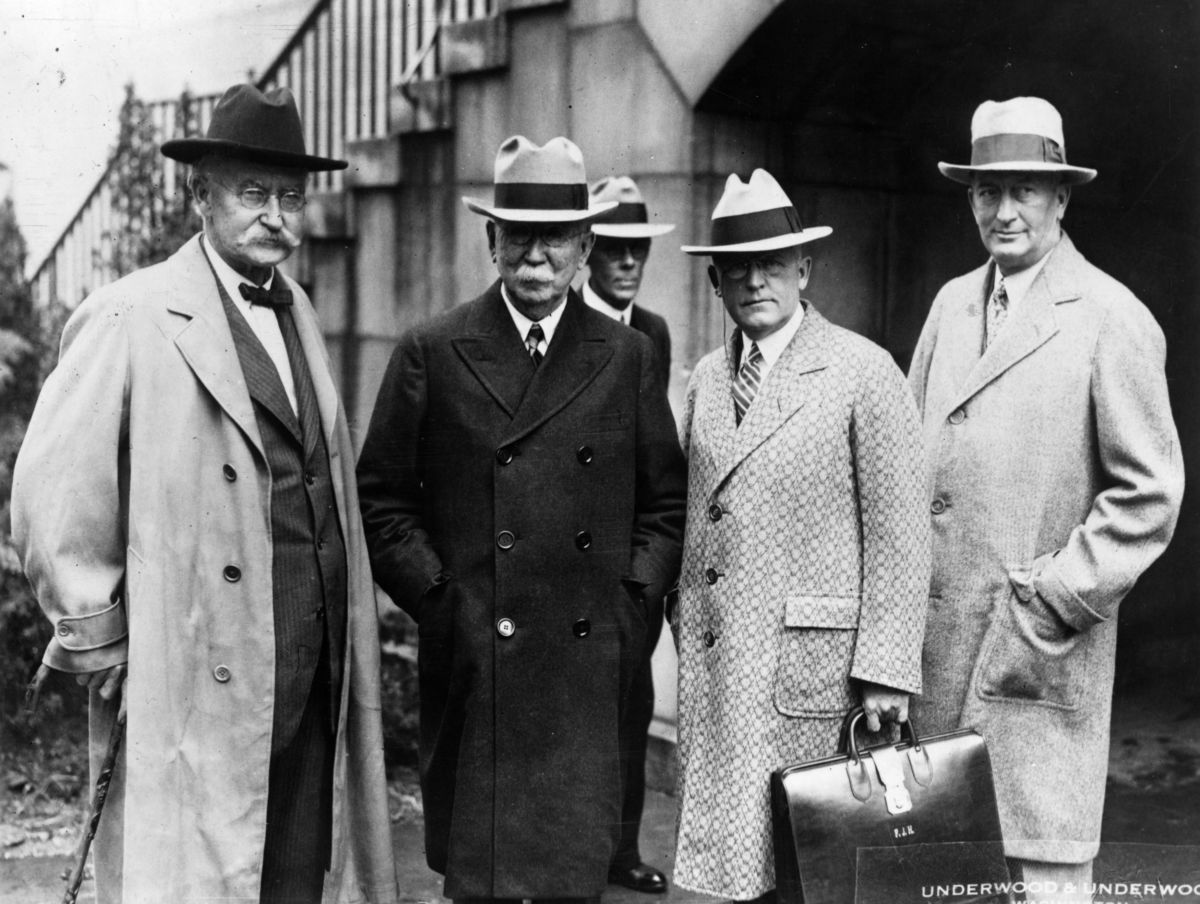

The Teapot Dome scandal also embroiled Harding’s attorney general Harry M. Daugherty, who was lambasted for not investigating Secretary of the Interior Fall more rigorously. Two special counsels—one Republican and one Democrat—were appointed by President Coolidge to investigate Fall. (Coolidge had become president after Harding abruptly died in 1923). The kerfuffle over the attorney general Daugherty’s actions led to a fight over Congress’s subpoena power, which was ultimately resolved by the Supreme Court. That ruling could be newly relevant if Congress wishes to compel testimony on the contents of Trump’s taxes and business records.

Congress’ investigation into the Teapot Dome scandal escalated when a Senate committee subpoenaed Mally S. Daugherty, the brother of the then-former Harding Attorney General Harry M. Daugherty. When Mally Daugherty refused to show up to testify before Congress, the Senate Sergeant at Arms David S. Barry deputized John J. McGrain to arrest him and bring him to Washington to testify. Daugherty’s lawyer got him released from detention after he convinced a judge that Congress did not have the power to compel Daugherty to testify or to arrest him for not complying. The case ended up in the Supreme Court, which affirmed the power of Congress to compel testimony (and to arrest people who refused a lawful Congressional subpoena to testify).

As the Justice Willis Van Devanter wrote in the opinion for a unanimous Court in McGrain v. Daugherty, 273 U.S. 135 (1927),“[a] legislative body cannot legislate wisely or effectively in the absence of information respecting the conditions which the legislation is intended to affect or change, and where the legislative body does not itself possess the requisite information — which not infrequently is true — recourse must be had to others who do possess it.”

The Teapot Dome scandal inspired additional federal reforms such as the Federal Corrupt Practices Act of 1925, which expanded federal campaign finance disclosure requirements and included expenditure caps for congressional candidates. Another reform was the Revenue Act of 1924, which provided the chairs of the House Ways and Means and Senate Finance Committees with the ability to demand tax returns from the IRS.

The chairman of the Ways and Means Committee is well within his statutory rights today under the Revenue Act of 1924 to obtain the president’s personal and business tax returns. And if Congress wanted to subpoena people to testify about the president’s businesses — including family — McGrain v. Daugherty gives them that power too.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.